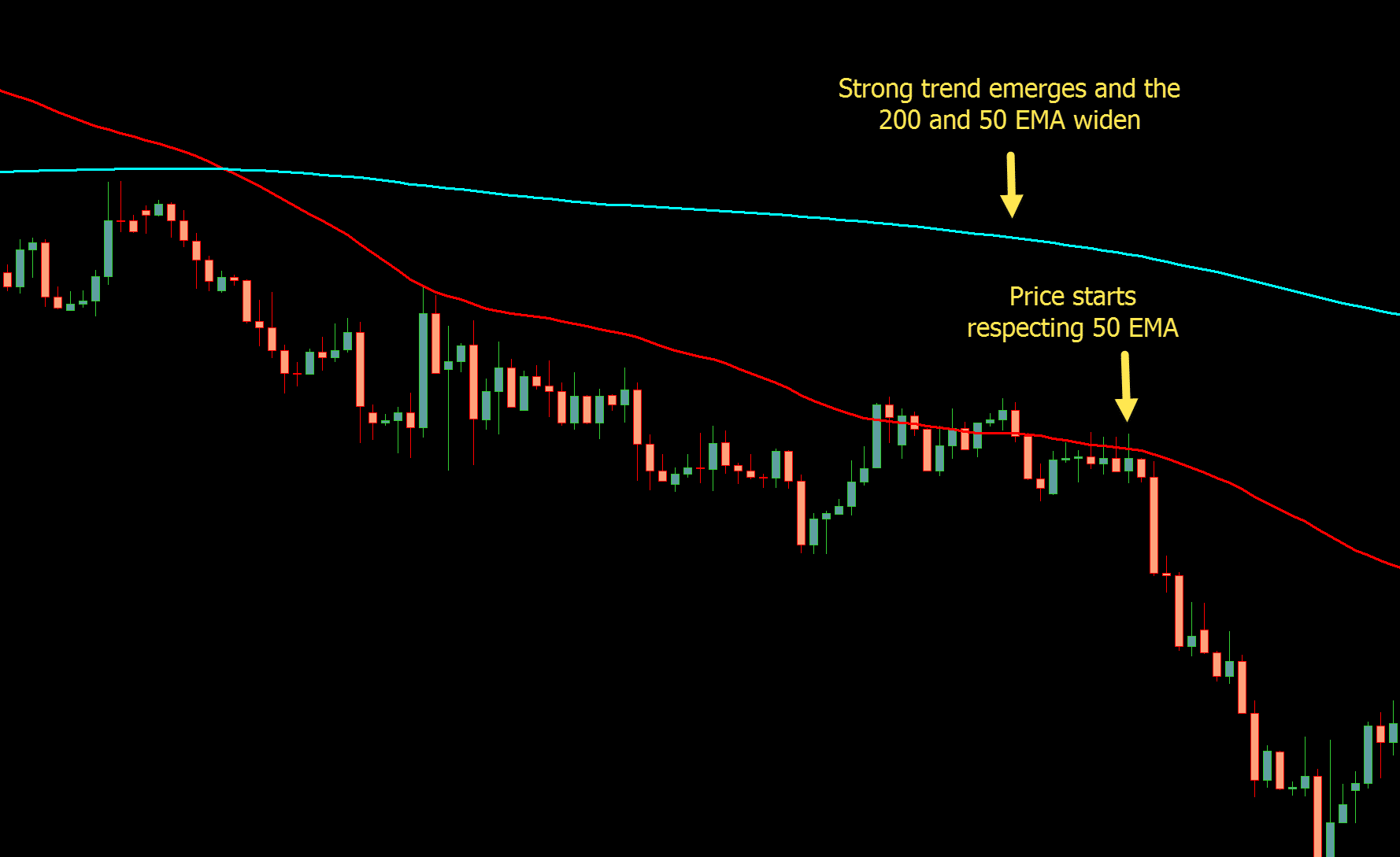

For example a 200 day moving average is using the last 200 days price information. The moving average is created by showing the average price over a set period of candles or time. It can also help you find dynamic support and resistance. The moving average is an indicator that smooths out the price action’s moves and helps you find clear trends. EMA 50 Crosses EMA 200 Trading Strategy.

#200 ema strategy how to#

How to Use the 200 EMA Indicator on MT4 and MT5.You only need two or three of these in an entire week to make 1%+ weekly profit. You’ll pay 2 or so pips for the spread but the rest is profit. You can easily pick up 5-10 pips per day by following this simple routine. The breakdown in price will be easily spotted on the M1 chart.

It’s exceptionally rare that you’ll find price deny all four of those standards. Now wait for the histogram to peak IN TANDEM with a crossover through the high or low line on the stoch AND in tandem with hitting one of the pivot points. Now find where it tends to retrace to (often the 16 or 50 EMA). Here’s a simple and highly reliable confluence:įind a H1 trend. All of which is governed by years of experience. The problem lies in being able to filter out bad signals and knowing when multi-TF analysis should counter “obvious” trades. Then again, 95% of members here are paper traders.įinally, a simple MACD histogram approach works well on scalping lower TFs- H1 down to M5. I’m amazed that it never comes up on this forum, especially given that it’s discussed all the time on non-Reddit forex forums. Kathy Lien covered the use of the 200 EMA with MACD confluence in one of her books. The best confluence is actually to combine it with the stochastic, though stochastic signals tend to play out better on ranges. Neither is it mysterious- price is overcoming a short-term cycle and indicating a probable move. It’s basically a momentum strategy and it’s not remotely novel. You know why? Because it’s simple and it’s old and it’s worked for decades. I wrote out an almost verbatim “strategy” (I hate that term) about a year ago and guess what? It was virtually ignored. Trading the 4h is going to be very beneficial since you barely have to assign any time for it, and it takes alot of pressure off of your trading. Something you can do on the other hand is try trading the 4H, yeah it wont bring any insane quick returns, but backtest the 4h on every pair since the beginning of 2019, and then calculate the total returns. Make sure to adjust the times on that indicator according to your timezone. Look for trades only in the NY session, or only in the London session in your backtesting, see if your win rate / profitability is impacted. Also, if u wanna eliminate the factor of missing trades due to being asleep in backtesting, there's an indicator which pulls up the market sessions on your charts, and lets you see the certain candles in that session. Like u/whyislifelikethis_ mentioned, 50 trades is too less, when you're trading 15m and are likely to miss this many trades, gather about 200 I'd say. These 2 things are single handedly have the ability to destroy your win rate. if you're trading the 15m, you're going to miss ALOT of trades simply by not being awake, and miss even more trades due to things like confused if the setup is quality or not. Considering that you get 0 drawdown at times, try placing your stop loss above the previous candle and aim for a higher R, possibly bigger returns over time?Ģndly, in my opinion, backtesting a strategy on the 15m that's this relative isn't the best idea. Have you tried having variations for this strategy, for example, where is your stop-loss placement. Check out the exampleĢ Things : Nice strategy! Love the fact that it's simple.

Stop loss is set to slightly below the swing low of the MACD cycle that crossed over (including pins). MACD and its signal line is below 0 (signal line can touch 0 and be valid).Įnter on the next candle that causes the MACD to cross the signal line upwards. Stop loss is determined in the contents below The link contents may change, idk how the sharing actually works. Couldn't show first 15 trades from July since TradingView stopped showing the charts that far back on M15. I chose 50 EMA over 200 EMA after finding the 50 EMA saves you from a few losing trades, probably since it's more responsive. Entries are triggered by a MACD crossover. This is a simple strategy where you look for long trades above the 50 EMA and short trades below the 50 EMA. I'm currently forward testing with a small account size. Note: the data set is only 50 trades over 3 months.

0 kommentar(er)

0 kommentar(er)